Basics of Stock Backtesting in Python

Stock Backtesting in Python is way of testing our strategy in a historical data to see if our strategy makes any money or not. Let’s start with a simple story.

John and Joe are two best friends. They both earned some money from their hard working corporate job and wanted to invest it in a stock market. Unlike Joe, John is clever and does not fall for any influence of stock’s price increasing and decreasing. They studied some Statistics and Probability along with Economics in college and and they love their money. Joe followed trend and bought some stock of X and felt glad that his stock’s price increased by some % in few days. John was calm person and thought that John’s stock position is increased but he is not earning any money and only way to earn is by selling it. John wanted to get back in time and questioned himself what will happen if I try to buy some stock of X and sell it if price increased by 10% or decrease by 5%. Then I will buy as much stock as possible from the amount I have. How much would have I earned today? Well he did not know but what he tried to do is a simple stock backtesting example.

Here in this stock backtesting blog, we will start with our very simple strategy and then try to use of the most popular stock backtesting Python package Backtesting.py. But first, let’s install it.

!pip install backtesting

Requirement already satisfied: backtesting in c:\programdata\anaconda3\lib\site-packages (0.3.3)

Requirement already satisfied: numpy>=1.17.0 in c:\programdata\anaconda3\lib\site-packages (from backtesting) (1.19.2)

Requirement already satisfied: pandas!=0.25.0,>=0.25.0 in c:\users\viper\appdata\roaming\python\python38\site-packages (from backtesting) (1.3.5)

Requirement already satisfied: bokeh>=1.4.0 in c:\users\viper\appdata\roaming\python\python38\site-packages (from backtesting) (2.4.3)

Requirement already satisfied: python-dateutil>=2.7.3 in c:\programdata\anaconda3\lib\site-packages (from pandas!=0.25.0,>=0.25.0->backtesting) (2.8.1)

Requirement already satisfied: pytz>=2017.3 in c:\programdata\anaconda3\lib\site-packages (from pandas!=0.25.0,>=0.25.0->backtesting) (2020.1)

Requirement already satisfied: Jinja2>=2.9 in c:\programdata\anaconda3\lib\site-packages (from bokeh>=1.4.0->backtesting) (2.11.2)

Requirement already satisfied: tornado>=5.1 in c:\programdata\anaconda3\lib\site-packages (from bokeh>=1.4.0->backtesting) (6.0.4)

Requirement already satisfied: packaging>=16.8 in c:\programdata\anaconda3\lib\site-packages (from bokeh>=1.4.0->backtesting) (20.4)

Requirement already satisfied: typing-extensions>=3.10.0 in c:\users\viper\appdata\roaming\python\python38\site-packages (from bokeh>=1.4.0->backtesting) (4.3.0)

Requirement already satisfied: pillow>=7.1.0 in c:\programdata\anaconda3\lib\site-packages (from bokeh>=1.4.0->backtesting) (8.0.1)

Requirement already satisfied: PyYAML>=3.10 in c:\users\viper\appdata\roaming\python\python38\site-packages (from bokeh>=1.4.0->backtesting) (6.0)

Requirement already satisfied: six>=1.5 in c:\programdata\anaconda3\lib\site-packages (from python-dateutil>=2.7.3->pandas!=0.25.0,>=0.25.0->backtesting) (1.15.0)

Requirement already satisfied: MarkupSafe>=0.23 in c:\programdata\anaconda3\lib\site-packages (from Jinja2>=2.9->bokeh>=1.4.0->backtesting) (1.1.1)

Requirement already satisfied: pyparsing>=2.0.2 in c:\users\viper\appdata\roaming\python\python38\site-packages (from packaging>=16.8->bokeh>=1.4.0->backtesting) (3.0.9)

Before going into stock backtesting, lets choose the data of any stock. We will choose data of AAPL from yfinance. If it is not installed, we can do so by pip install yfinance.

!pip install yfinance --user

Requirement already satisfied: yfinance in c:\users\viper\appdata\roaming\python\python38\site-packages (0.1.87)

Requirement already satisfied: requests>=2.26 in c:\users\viper\appdata\roaming\python\python38\site-packages (from yfinance) (2.28.1)

Requirement already satisfied: pandas>=0.24.0 in c:\users\viper\appdata\roaming\python\python38\site-packages (from yfinance) (1.3.5)

Requirement already satisfied: multitasking>=0.0.7 in c:\users\viper\appdata\roaming\python\python38\site-packages (from yfinance) (0.0.11)

Requirement already satisfied: appdirs>=1.4.4 in c:\programdata\anaconda3\lib\site-packages (from yfinance) (1.4.4)

Requirement already satisfied: lxml>=4.5.1 in c:\programdata\anaconda3\lib\site-packages (from yfinance) (4.6.1)

Requirement already satisfied: numpy>=1.15 in c:\programdata\anaconda3\lib\site-packages (from yfinance) (1.19.2)

Requirement already satisfied: charset-normalizer<3,>=2 in c:\users\viper\appdata\roaming\python\python38\site-packages (from requests>=2.26->yfinance) (2.1.0)

Requirement already satisfied: urllib3<1.27,>=1.21.1 in c:\users\viper\appdata\roaming\python\python38\site-packages (from requests>=2.26->yfinance) (1.25.11)

Requirement already satisfied: certifi>=2017.4.17 in c:\programdata\anaconda3\lib\site-packages (from requests>=2.26->yfinance) (2020.6.20)

Requirement already satisfied: idna<4,>=2.5 in c:\programdata\anaconda3\lib\site-packages (from requests>=2.26->yfinance) (2.10)

Requirement already satisfied: pytz>=2017.3 in c:\programdata\anaconda3\lib\site-packages (from pandas>=0.24.0->yfinance) (2020.1)

Requirement already satisfied: python-dateutil>=2.7.3 in c:\programdata\anaconda3\lib\site-packages (from pandas>=0.24.0->yfinance) (2.8.1)

Requirement already satisfied: six>=1.5 in c:\programdata\anaconda3\lib\site-packages (from python-dateutil>=2.7.3->pandas>=0.24.0->yfinance) (1.15.0)

import pandas as pd

import yfinance as yf

Next is to download data. We can download data as following.

data = yf.download("AAPL", start="2015-01-01", end="2022-04-30")

del data['Adj Close']

del data['Volume']

data

[*********************100%***********************] 1 of 1 completed

| Open | High | Low | Close | |

|---|---|---|---|---|

| Date | ||||

| 2015-01-02 | 27.847500 | 27.860001 | 26.837500 | 27.332500 |

| 2015-01-05 | 27.072500 | 27.162500 | 26.352501 | 26.562500 |

| 2015-01-06 | 26.635000 | 26.857500 | 26.157499 | 26.565001 |

| 2015-01-07 | 26.799999 | 27.049999 | 26.674999 | 26.937500 |

| 2015-01-08 | 27.307501 | 28.037500 | 27.174999 | 27.972500 |

| ... | ... | ... | ... | ... |

| 2022-04-25 | 161.119995 | 163.169998 | 158.460007 | 162.880005 |

| 2022-04-26 | 162.250000 | 162.339996 | 156.720001 | 156.800003 |

| 2022-04-27 | 155.910004 | 159.789993 | 155.380005 | 156.570007 |

| 2022-04-28 | 159.250000 | 164.520004 | 158.929993 | 163.639999 |

| 2022-04-29 | 161.839996 | 166.199997 | 157.250000 | 157.649994 |

1845 rows × 4 columns

Our data will be daily floorsheet data and we will make stock backtesting strategy on it. Alternatively we could get data for testing from backtesting.py too but it only allows GOOG.

import backtesting.test as btest

btest.GOOG

| Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|

| 2004-08-19 | 100.00 | 104.06 | 95.96 | 100.34 | 22351900 |

| 2004-08-20 | 101.01 | 109.08 | 100.50 | 108.31 | 11428600 |

| 2004-08-23 | 110.75 | 113.48 | 109.05 | 109.40 | 9137200 |

| 2004-08-24 | 111.24 | 111.60 | 103.57 | 104.87 | 7631300 |

| 2004-08-25 | 104.96 | 108.00 | 103.88 | 106.00 | 4598900 |

| ... | ... | ... | ... | ... | ... |

| 2013-02-25 | 802.30 | 808.41 | 790.49 | 790.77 | 2303900 |

| 2013-02-26 | 795.00 | 795.95 | 784.40 | 790.13 | 2202500 |

| 2013-02-27 | 794.80 | 804.75 | 791.11 | 799.78 | 2026100 |

| 2013-02-28 | 801.10 | 806.99 | 801.03 | 801.20 | 2265800 |

| 2013-03-01 | 797.80 | 807.14 | 796.15 | 806.19 | 2175400 |

2148 rows × 5 columns

Preparing SMA

We will work on our data from yfinance next. There is a good availability of classes and modules for stock backtesting and lets use them instead of writing our own indicators. But I have written many indicators from scratch and you can find them here. Here, SMA stands for Simple Moving Average.

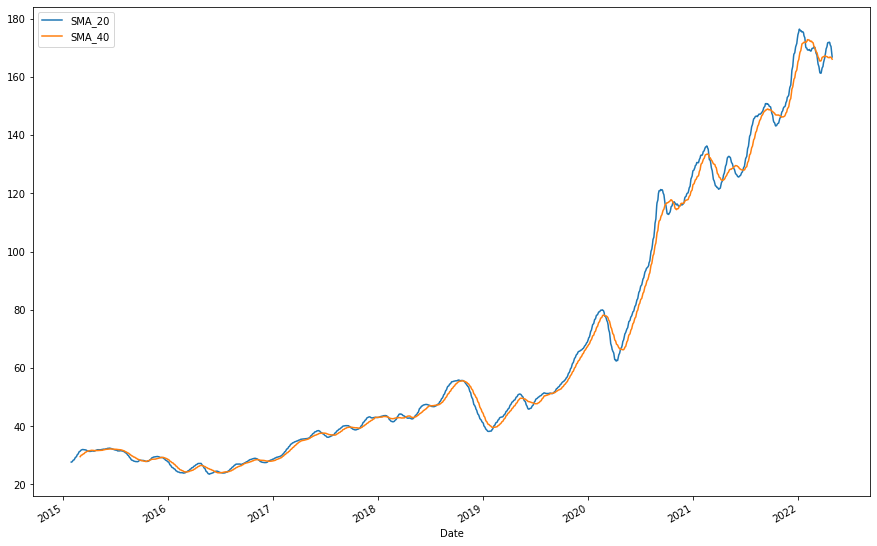

We start by making a class that inherits Strategy class inside backtesting and we do not need anything at all at this time but lets use crossover and SMA too. But this will be covered later. First lets take a look into our data and try to plot SMA of two periods, one longer and one shorter. One SMA of 20 days and another of 40 days. Our simple stock backtesting strategy will be to buy when small SMA crosses over bigger SMA.

n1,n2=20,40

ndata = data.copy()

ndata[f'SMA_{n1}'] = ndata.Close.rolling(n1).mean()

ndata[f'SMA_{n2}'] = ndata.Close.rolling(n2).mean()

ndata[[f'SMA_{n1}', f'SMA_{n2}']].plot(figsize=(15,10))

<AxesSubplot:xlabel='Date'>

We can see that SMA_20 and SMA_40 are crossing over each other in multiple times. But the plot looks little huge so lets take data of last 200 days only.

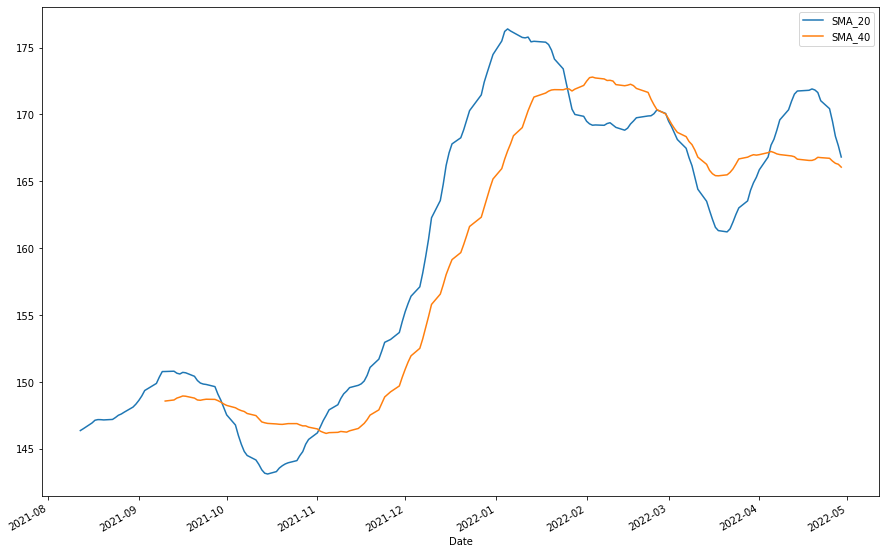

last = 200

n1,n2=20,40

tdata = data.copy().tail(last)

tdata[f'SMA_{n1}'] = tdata.Close.rolling(n1).mean()

tdata[f'SMA_{n2}'] = tdata.Close.rolling(n2).mean()

tdata[[f'SMA_{n1}', f'SMA_{n2}']].plot(figsize=(15,10))

<AxesSubplot:xlabel='Date'>

Our Simple Strategy

Now let’s make our stock backtesting strategy. If the short SMA crosses over large SMA, we buy and hold positions because we saw that it has increased the value of price recently and could increase in future too. But if short SMA crosses below large SMA, we sell our holding positions because there has been recent price drops. In above example we will do trades whenever crossover happens. A simple way to find a crossover is by comparing difference between current price and previous. If the difference was positive in past and negative now then we do trade and vice versa. Note that we buy on the Open price of next day.

tdata['sma1_gt_sma2'] = tdata[f'SMA_{n1}']>tdata[f'SMA_{n2}']

tdata['crossed'] = (tdata.sma1_gt_sma2!=tdata.sma1_gt_sma2.shift(1))

print(f"Num Corssed: {tdata.crossed.sum()-1}")

tdata

Num Corssed: 7

| Open | High | Low | Close | SMA_20 | SMA_40 | sma1_gt_sma2 | crossed | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2021-07-16 | 148.460007 | 149.759995 | 145.880005 | 146.389999 | NaN | NaN | False | True |

| 2021-07-19 | 143.750000 | 144.070007 | 141.669998 | 142.449997 | NaN | NaN | False | False |

| 2021-07-20 | 143.460007 | 147.100006 | 142.960007 | 146.149994 | NaN | NaN | False | False |

| 2021-07-21 | 145.529999 | 146.130005 | 144.630005 | 145.399994 | NaN | NaN | False | False |

| 2021-07-22 | 145.940002 | 148.199997 | 145.809998 | 146.800003 | NaN | NaN | False | False |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2022-04-25 | 161.119995 | 163.169998 | 158.460007 | 162.880005 | 170.435000 | 166.72550 | True | False |

| 2022-04-26 | 162.250000 | 162.339996 | 156.720001 | 156.800003 | 169.495000 | 166.51750 | True | False |

| 2022-04-27 | 155.910004 | 159.789993 | 155.380005 | 156.570007 | 168.375500 | 166.35175 | True | False |

| 2022-04-28 | 159.250000 | 164.520004 | 158.929993 | 163.639999 | 167.668999 | 166.27875 | True | False |

| 2022-04-29 | 161.839996 | 166.199997 | 157.250000 | 157.649994 | 166.820999 | 166.06425 | True | False |

200 rows × 8 columns

In above code, we made new column where we checked if SMA1 is higher than SMA2 or not and in next crossed column we checked if the status of SMA1>SMA2 still holds same from the previous time. And when it is false, we do trade. We should ignore the first one because it will give us NaN value on shift. Let’s assume that we have USD 10000 in cash and want to do trade. Since we have SMA1>SMA2 column, we buy only when there is crossed True and sma1_gt_sma2 True as well. And we sell only when there is crossed True and sma1_gt_sma2 is False.

Trading Result

To find stock backtesting trades data, we loop through the data and if yesterday’s SMA1>SMA2 then we buy on today’s Open price and selling happens on same way.

- If crossed and SMA1>SMA2: buy positions based on remaining amount and add positions.

- If crossed and SMA1<SMA2: sell available positions and add remaining amount.

- On last day sell all positions and add remaining amount.

ntdata = tdata.reset_index().copy()

ntdata['crossed']=ntdata.crossed.shift(1)

ntdata['sma1_gt_sma2']=ntdata.sma1_gt_sma2.shift(1)

positions = 0

rem_amt=10000

lr = len(ntdata)-1

trades = []

tinfo=[]

for i, row in ntdata.iterrows():

if i!=0:

if row.crossed and row.sma1_gt_sma2:

positions=int(rem_amt/row.Open)

rem_amt= rem_amt-row.Open*positions

tinfo.append(positions)

tinfo.append(row.Open)

tinfo.append(row.Date)

if row.crossed==True and row.sma1_gt_sma2==False and positions>0:

rem_amt = rem_amt+row.Open*positions

tinfo.append(row.Date)

tinfo.append(row.Open)

trades.append(tinfo)

tinfo=[]

positions = 0

if i==lr and positions>0:

rem_amt=rem_amt + positions*row.Open

tinfo.append(row.Date)

tinfo.append(row.Open)

trades.append(tinfo)

positions = 0

ntdata.loc[i, 'positions'] = positions

ntdata.loc[i, 'rem_amount'] = rem_amt

trades = pd.DataFrame(trades, columns=['Positions', 'Buy', 'Entry', 'Exit', 'Sell'])

trades['return']=((trades['Sell']-trades['Buy'])*trades.Positions).cumsum()

trades

| Positions | Buy | Entry | Exit | Sell | return | |

|---|---|---|---|---|---|---|

| 0 | 66 | 150.630005 | 2021-09-13 | 2021-10-01 | 141.899994 | -576.180725 |

| 1 | 62 | 150.389999 | 2021-11-03 | 2022-01-27 | 162.449997 | 171.539124 |

| 2 | 61 | 164.699997 | 2022-03-01 | 2022-03-02 | 164.389999 | 152.629272 |

| 3 | 58 | 172.360001 | 2022-04-06 | 2022-04-29 | 161.839996 | -457.530975 |

Looking over the above table, in return column, we are in 457 loss overall. What if we did this testing with larger period of data?

Our Strategy in a Larger Period

Lets start from the last 1000 day and forth.

n1,n2=20,40

last = 1000

tdata = data.copy().tail(last)

tdata[f'SMA_{n1}'] = tdata.Close.rolling(n1).mean()

tdata[f'SMA_{n2}'] = tdata.Close.rolling(n2).mean()

tdata['sma1_gt_sma2'] = tdata[f'SMA_{n1}']>tdata[f'SMA_{n2}']

tdata['crossed'] = (tdata.sma1_gt_sma2!=tdata.sma1_gt_sma2.shift(1))

print(f"Num Corssed: {tdata.crossed.sum()-1}")

ntdata = tdata.reset_index().copy()

ntdata['crossed']=ntdata.crossed.shift(1)

ntdata['sma1_gt_sma2']=ntdata.sma1_gt_sma2.shift(1)

positions = 0

rem_amt=10000

lr = len(ntdata)-1

trades = []

tinfo=[]

for i, row in ntdata.iterrows():

if i!=0:

if row.crossed and row.sma1_gt_sma2:

positions=int(rem_amt/row.Open)

rem_amt= rem_amt-row.Open*positions

tinfo.append(positions)

tinfo.append(row.Open)

tinfo.append(row.Date)

if row.crossed==True and row.sma1_gt_sma2==False and positions>0:

rem_amt = rem_amt+row.Open*positions

tinfo.append(row.Date)

tinfo.append(row.Open)

trades.append(tinfo)

tinfo=[]

positions = 0

if i==lr and positions>0:

rem_amt=rem_amt + positions*row.Open

tinfo.append(row.Date)

tinfo.append(row.Open)

trades.append(tinfo)

positions = 0

ntdata.loc[i, 'positions'] = positions

ntdata.loc[i, 'rem_amount'] = rem_amt

trades = pd.DataFrame(trades, columns=['Positions', 'Buy', 'Entry', 'Exit', 'Sell'])

trades['return']=((trades['Sell']-trades['Buy'])*trades.Positions).cumsum()

trades

Num Corssed: 23

| Positions | Buy | Entry | Exit | Sell | return | |

|---|---|---|---|---|---|---|

| 0 | 205 | 48.652500 | 2018-07-26 | 2018-10-26 | 53.974998 | 1091.112156 |

| 1 | 257 | 43.099998 | 2019-02-07 | 2019-05-23 | 44.950001 | 1566.562744 |

| 2 | 232 | 49.669998 | 2019-06-28 | 2019-08-28 | 51.025002 | 1880.923523 |

| 3 | 228 | 52.097500 | 2019-09-04 | 2020-03-02 | 70.570000 | 6092.653488 |

| 4 | 232 | 69.300003 | 2020-04-24 | 2020-09-29 | 114.550003 | 16590.653488 |

| 5 | 233 | 114.010002 | 2020-10-26 | 2020-11-18 | 118.610001 | 17662.453133 |

| 6 | 228 | 121.010002 | 2020-12-01 | 2021-02-26 | 122.589996 | 18022.691811 |

| 7 | 207 | 134.940002 | 2021-04-14 | 2021-05-24 | 126.010002 | 16174.181747 |

| 8 | 194 | 134.449997 | 2021-06-24 | 2021-10-01 | 141.899994 | 17619.481155 |

| 9 | 183 | 150.389999 | 2021-11-03 | 2022-01-27 | 162.449997 | 19826.460709 |

| 10 | 181 | 164.699997 | 2022-03-01 | 2022-03-02 | 164.389999 | 19770.351151 |

| 11 | 172 | 172.360001 | 2022-04-06 | 2022-04-29 | 161.839996 | 17960.910416 |

It looks like we actually made some money while testing on larger period.

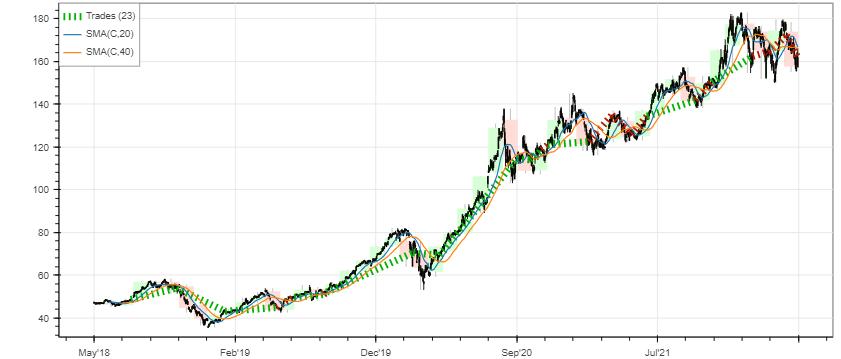

Strategy with Backtesting

Until now we designed a very simple strategy and did trading and to do so, we had to write too many codes but why do we need to struggle that hard while there is already one open source package available which handles our struggles? Following is a modified version of our strategy and it is modified from the Quick Start page.

from backtesting import Strategy

from backtesting.lib import crossover

from backtesting.test import SMA

class SmaCross(Strategy):

# Define the two MA lags as *class variables*

# for later optimization

n1 = 20

n2 = 40

def init(self):

# Precompute the two moving averages

self.sma1 = self.I(SMA, self.data.Close, self.n1)

self.sma2 = self.I(SMA, self.data.Close, self.n2)

def next(self):

# If sma1 crosses above sma2, close any existing

# short trades, and buy the asset

if crossover(self.sma1, self.sma2):

self.position.close()

self.buy()

# Else, if sma1 crosses below sma2, close any existing

# long trades, and sell the asset

elif crossover(self.sma2, self.sma1):

self.position.close()

self.sell()

from backtesting import Backtest

bt = Backtest(data.tail(last), SmaCross, cash=10000, commission=0)

stats = bt.run()

stats

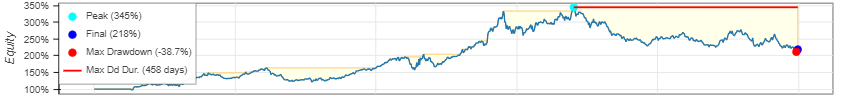

Start 2018-05-11 00:00:00

End 2022-04-29 00:00:00

Duration 1449 days 00:00:00

Exposure Time [%] 94.8

Equity Final [$] 21836.199413

Equity Peak [$] 34464.403912

Return [%] 118.361994

Buy & Hold Return [%] 234.376153

Return (Ann.) [%] 21.751022

Volatility (Ann.) [%] 38.394298

Sharpe Ratio 0.566517

Sortino Ratio 1.031964

Calmar Ratio 0.562183

Max. Drawdown [%] -38.690305

Avg. Drawdown [%] -5.507696

Max. Drawdown Duration 458 days 00:00:00

Avg. Drawdown Duration 34 days 00:00:00

# Trades 23

Win Rate [%] 52.173913

Best Trade [%] 65.295812

Worst Trade [%] -10.50055

Avg. Trade [%] 3.457111

Max. Trade Duration 180 days 00:00:00

Avg. Trade Duration 60 days 00:00:00

Profit Factor 2.831255

Expectancy [%] 4.500417

SQN 0.873935

_strategy SmaCross

_equity_curve ...

_trades Size EntryB...

dtype: object

We start by importing necessary classes and methods. We create a new class for our own strategy which inherits Strategy. We initialize variables and then SMA. When doing run(), the next() method loops through the data rows and perform checks inside it. We can pass commission percent to calculate how much commission do we have to pay to our broker.

Trades

The trades table using backtesting is different than ours.

stats['_trades'] # Contains individual trade data

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 205 | 52 | 117 | 48.652500 | 53.974998 | 1091.112156 | 0.109398 | 2018-07-26 | 2018-10-26 | 92 days |

| 1 | -205 | 117 | 186 | 53.974998 | 43.099998 | 2229.375000 | 0.201482 | 2018-10-26 | 2019-02-07 | 104 days |

| 2 | 309 | 186 | 259 | 43.099998 | 44.950001 | 571.650707 | 0.042923 | 2019-02-07 | 2019-05-23 | 105 days |

| 3 | -309 | 259 | 284 | 44.950001 | 49.669998 | -1458.479198 | -0.105006 | 2019-05-23 | 2019-06-28 | 36 days |

| 4 | 250 | 284 | 326 | 49.669998 | 51.025002 | 338.750839 | 0.027280 | 2019-06-28 | 2019-08-28 | 61 days |

| 5 | -250 | 326 | 330 | 51.025002 | 52.097500 | -268.124580 | -0.021019 | 2019-08-28 | 2019-09-04 | 7 days |

| 6 | 240 | 330 | 453 | 52.097500 | 70.570000 | 4433.399963 | 0.354576 | 2019-09-04 | 2020-03-02 | 180 days |

| 7 | -240 | 453 | 491 | 70.570000 | 69.300003 | 304.799194 | 0.017996 | 2020-03-02 | 2020-04-24 | 53 days |

| 8 | 248 | 491 | 600 | 69.300003 | 114.550003 | 11222.000000 | 0.652958 | 2020-04-24 | 2020-09-29 | 158 days |

| 9 | -248 | 600 | 619 | 114.550003 | 114.010002 | 133.920227 | 0.004714 | 2020-09-29 | 2020-10-26 | 27 days |

| 10 | 250 | 619 | 636 | 114.010002 | 118.610001 | 1149.999619 | 0.040347 | 2020-10-26 | 2020-11-18 | 23 days |

| 11 | -250 | 636 | 644 | 118.610001 | 121.010002 | -600.000381 | -0.020234 | 2020-11-18 | 2020-12-01 | 13 days |

| 12 | 240 | 644 | 703 | 121.010002 | 122.589996 | 379.198608 | 0.013057 | 2020-12-01 | 2021-02-26 | 87 days |

| 13 | -240 | 703 | 735 | 122.589996 | 134.940002 | -2964.001465 | -0.100742 | 2021-02-26 | 2021-04-14 | 47 days |

| 14 | 196 | 735 | 763 | 134.940002 | 126.010002 | -1750.280060 | -0.066178 | 2021-04-14 | 2021-05-24 | 40 days |

| 15 | -196 | 763 | 785 | 126.010002 | 134.449997 | -1654.238983 | -0.066979 | 2021-05-24 | 2021-06-24 | 31 days |

| 16 | 172 | 785 | 854 | 134.449997 | 141.899994 | 1281.399475 | 0.055411 | 2021-06-24 | 2021-10-01 | 99 days |

| 17 | -172 | 854 | 877 | 141.899994 | 150.389999 | -1460.280945 | -0.059831 | 2021-10-01 | 2021-11-03 | 33 days |

| 18 | 152 | 877 | 935 | 150.389999 | 162.449997 | 1833.119629 | 0.080191 | 2021-11-03 | 2022-01-27 | 85 days |

| 19 | -152 | 935 | 957 | 162.449997 | 164.699997 | -342.000000 | -0.013850 | 2022-01-27 | 2022-03-01 | 33 days |

| 20 | 148 | 957 | 958 | 164.699997 | 164.389999 | -45.879639 | -0.001882 | 2022-03-01 | 2022-03-02 | 1 days |

| 21 | -148 | 958 | 983 | 164.389999 | 172.360001 | -1179.560181 | -0.048482 | 2022-03-02 | 2022-04-06 | 35 days |

| 22 | 134 | 983 | 999 | 172.360001 | 161.839996 | -1409.680573 | -0.061035 | 2022-04-06 | 2022-04-29 | 23 days |

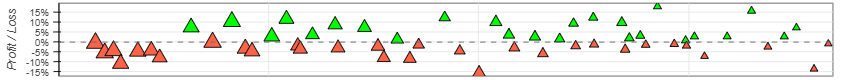

Plotting

We can even plot our trading with bokeh plot. It is interactive just like plotly

bt.plot()

Stop Profit and Stop Loss

Profit and stop loss are often used to stay in the safe side. We exit from the trade when there is increase in price and take a profit but reversely, we exit from the trade when there is decrease in price and realize loss.

from backtesting import Strategy

from backtesting.lib import crossover

from backtesting.test import SMA

class SmaCross(Strategy):

# Define the two MA lags as *class variables*

# for later optimization

n1 = 20

n2 = 40

def init(self):

# Precompute the two moving averages

self.sma1 = self.I(SMA, self.data.Close, self.n1)

self.sma2 = self.I(SMA, self.data.Close, self.n2)

def next(self):

# If sma1 crosses above sma2, close any existing

# short trades, and buy the asset

if crossover(self.sma1, self.sma2):

# self.position.close()

self.buy(tp=self.data.Close[-1]*1.2, sl=self.data.Close[-1]*0.95)

# Else, if sma1 crosses below sma2, close any existing

# long trades, and sell the asset

elif crossover(self.sma2, self.sma1):

self.position.close()

# self.sell()

from backtesting import Backtest

bt = Backtest(data.tail(last), SmaCross, cash=10000, commission=0)

stats = bt.run()

stats

Start 2018-05-11 00:00:00

End 2022-04-29 00:00:00

Duration 1449 days 00:00:00

Exposure Time [%] 39.7

Equity Final [$] 25715.433767

Equity Peak [$] 26697.815822

Return [%] 157.154338

Buy & Hold Return [%] 234.376153

Return (Ann.) [%] 26.872895

Volatility (Ann.) [%] 19.883748

Sharpe Ratio 1.351501

Sortino Ratio 2.733988

Calmar Ratio 2.457561

Max. Drawdown [%] -10.934783

Avg. Drawdown [%] -2.628023

Max. Drawdown Duration 163 days 00:00:00

Avg. Drawdown Duration 20 days 00:00:00

# Trades 12

Win Rate [%] 66.666667

Best Trade [%] 21.740146

Worst Trade [%] -5.359055

Avg. Trade [%] 8.20145

Max. Trade Duration 99 days 00:00:00

Avg. Trade Duration 47 days 00:00:00

Profit Factor 8.893546

Expectancy [%] 8.683464

SQN 2.395319

_strategy SmaCross

_equity_curve ...

_trades Size EntryB...

dtype: object

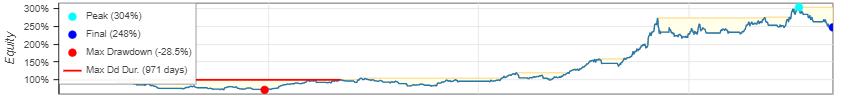

In above example, we exit the trade once price increases by 20% or decreases by 5%. Doing so we made some profit as well.

Our Own Strategy in Backtesting

Lets make our own strategy here and implement it on backtesting. I want to do something like below:

- If EMA 9 > EMA 20 or EMA 50 > EMA 100 then buy.

- If EMA 9 < EMA 20 or EMA 50 < EMA 100 then close positions.

For calculation of EMA, we can use pandas_ta. We can install it like pip install pandas-ta.

import pandas_ta as ta

from backtesting import Backtest

from backtesting import Strategy

from backtesting.lib import crossover

class EmaCross(Strategy):

def init(self):

self.ema9 = self.I(ta.ema, pd.Series(self.data.Close), 9)

self.ema20 = self.I(ta.ema, pd.Series(self.data.Close), 20)

self.ema50 = self.I(ta.ema, pd.Series(self.data.Close), 50)

self.ema100 = self.I(ta.ema, pd.Series(self.data.Close), 100)

def next(self):

if crossover(self.ema9, self.ema20) or crossover(self.ema50, self.ema100):

self.buy()

elif crossover(self.ema20, self.ema9) or crossover(self.ema100, self.ema50):

self.position.close()

# self.sell()

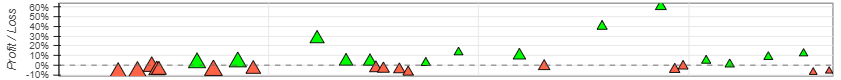

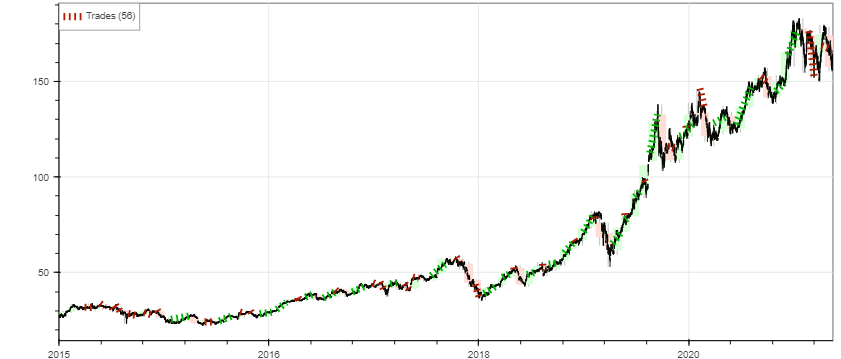

bt = Backtest(data, EmaCross, cash=10000, commission=0.02)

stats = bt.run()

bt.plot()

stats

Start 2015-01-02 00:00:00

End 2022-04-29 00:00:00

Duration 2674 days 00:00:00

Exposure Time [%] 63.631436

Equity Final [$] 24777.296183

Equity Peak [$] 30443.052752

Return [%] 147.772962

Buy & Hold Return [%] 476.785846

Return (Ann.) [%] 13.193633

Volatility (Ann.) [%] 21.81465

Sharpe Ratio 0.604806

Sortino Ratio 1.02413

Calmar Ratio 0.463525

Max. Drawdown [%] -28.463721

Avg. Drawdown [%] -4.544362

Max. Drawdown Duration 776 days 00:00:00

Avg. Drawdown Duration 53 days 00:00:00

# Trades 30

Win Rate [%] 46.666667

Best Trade [%] 60.672271

Worst Trade [%] -7.85946

Avg. Trade [%] 3.077886

Max. Trade Duration 190 days 00:00:00

Avg. Trade Duration 56 days 00:00:00

Profit Factor 2.584764

Expectancy [%] 3.953845

SQN 1.328035

_strategy EmaCross

_equity_curve ...

_trades Size EntryB...

dtype: object

Looks like we made some money. But this is just another bad strategy we tested.

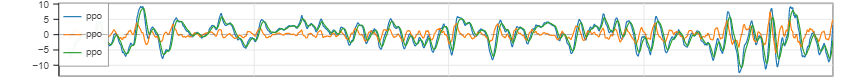

Testing Percentage Price Oscillator

Following is taken from my another blog.

- This is a momentum indicator (determines the strength or weakness of a value). But we can view the volatility too.

- Two EMAs, 26 period and 12 periods are used to calculate PPO.

- It contains 2 lines, PPO line and signal line. Signal line is an EMA of the 9 Period PPO, so it moves slower than PPO.

- When PPO line crosses the signal line, it is the time for rise/fall of the price or stock.

- When PPO line crosses over the signal line from below, then it is a buy signal. Reversely, it is a sell signal when PPO line crosses belo the signal line from above.

- When PPO line is below the 0, the short term average is below the longer-term average average, which helps indicate a fall of price.

- Conversely, when PPO line is above 0, the short term average is above the long term average, which helps indicate rise of price.

pandas_ta has PPO too so we do not have to write our own code for it.

ta.ppo(data.Close)

| PPO_12_26_9 | PPOh_12_26_9 | PPOs_12_26_9 | |

|---|---|---|---|

| 2015-01-02 | NaN | NaN | NaN |

| 2015-01-05 | NaN | NaN | NaN |

| 2015-01-06 | NaN | NaN | NaN |

| 2015-01-07 | NaN | NaN | NaN |

| 2015-01-08 | NaN | NaN | NaN |

| ... | ... | ... | ... |

| 2022-04-25 | -1.987252 | -2.241286 | 0.254034 |

| 2022-04-26 | -2.580172 | -2.267365 | -0.312807 |

| 2022-04-27 | -3.049812 | -2.189604 | -0.860208 |

| 2022-04-28 | -3.039588 | -1.743504 | -1.296084 |

| 2022-04-29 | -3.256113 | -1.568023 | -1.688090 |

1845 rows × 3 columns

class PPO(Strategy):

def init(self):

self.ppo = self.I(ta.ppo, pd.Series(self.data.Close))

def next(self):

if crossover(self.ppo[0], self.ppo[2]):

# if crossover(self.ppo[1], 0):

# self.position.close()

self.buy()

elif crossover(self.ppo[2], self.ppo[0]):

#if crossover(0,self.ppo[1]):

self.position.close()

# self.sell()

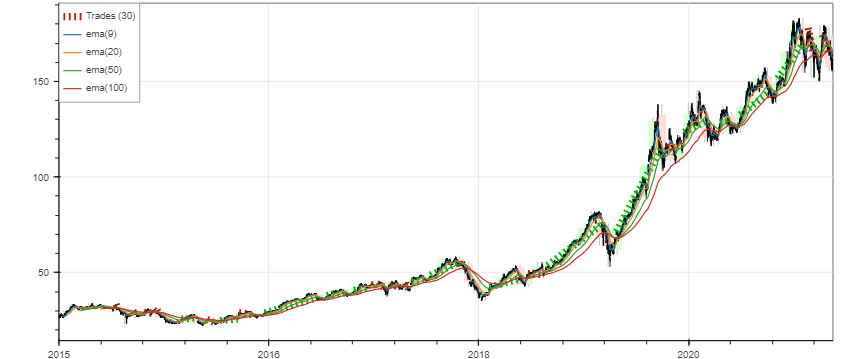

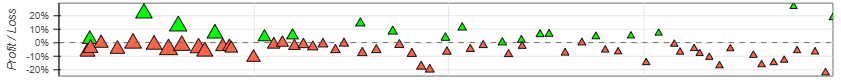

bt = Backtest(data, PPO, cash=10000, commission=0.02)

stats = bt.run()

bt.plot()

print(stats)

Start 2015-01-02 00:00:00

End 2022-04-29 00:00:00

Duration 2674 days 00:00:00

Exposure Time [%] 51.00271

Equity Final [$] 12163.349445

Equity Peak [$] 14453.298656

Return [%] 21.633494

Buy & Hold Return [%] 476.785846

Return (Ann.) [%] 2.711015

Volatility (Ann.) [%] 18.61385

Sharpe Ratio 0.145645

Sortino Ratio 0.22052

Calmar Ratio 0.067051

Max. Drawdown [%] -40.432272

Avg. Drawdown [%] -7.414292

Max. Drawdown Duration 1942 days 00:00:00

Avg. Drawdown Duration 169 days 00:00:00

# Trades 56

Win Rate [%] 44.642857

Best Trade [%] 17.890366

Worst Trade [%] -15.387924

Avg. Trade [%] 0.353242

Max. Trade Duration 70 days 00:00:00

Avg. Trade Duration 23 days 00:00:00

Profit Factor 1.242225

Expectancy [%] 0.592473

SQN 0.433939

_strategy PPO

_equity_curve ...

_trades Size EntryB...

dtype: object

Looks like we again made some money. There is not a golden rule that will make a money, its kind of hit and trial.

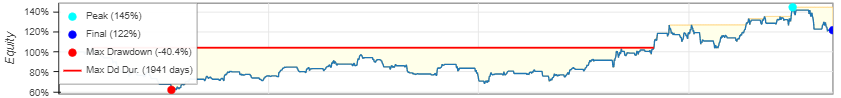

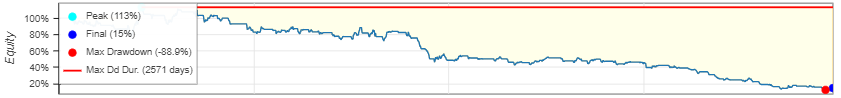

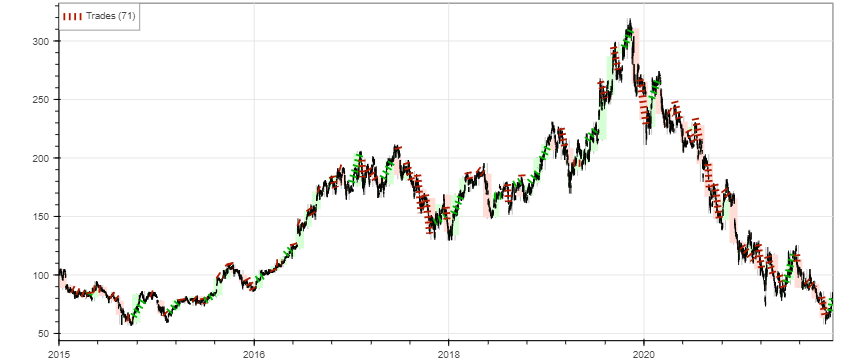

PPO on BABA

bdata = yf.download("BABA", start="2015-01-01", end="2022-11-30")

del bdata['Adj Close']

del bdata['Volume']

bt = Backtest(bdata, PPO, cash=10000, commission=0.02)

stats = bt.run()

bt.plot()

print(stats)

[*********************100%***********************] 1 of 1 completed

Start 2015-01-02 00:00:00

End 2022-11-18 00:00:00

Duration 2877 days 00:00:00

Exposure Time [%] 52.265861

Equity Final [$] 1485.461341

Equity Peak [$] 11330.885306

Return [%] -85.145387

Buy & Hold Return [%] -22.316598

Return (Ann.) [%] -21.491087

Volatility (Ann.) [%] 21.490062

Sharpe Ratio 0.0

Sortino Ratio 0.0

Calmar Ratio 0.0

Max. Drawdown [%] -88.917088

Avg. Drawdown [%] -28.010671

Max. Drawdown Duration 2571 days 00:00:00

Avg. Drawdown Duration 705 days 00:00:00

# Trades 71

Win Rate [%] 26.760563

Best Trade [%] 26.501533

Worst Trade [%] -22.092189

Avg. Trade [%] -2.73311

Max. Trade Duration 56 days 00:00:00

Avg. Trade Duration 20 days 00:00:00

Profit Factor 0.496783

Expectancy [%] -2.346556

SQN -2.054515

_strategy PPO

_equity_curve ...

_trades Size EntryB...

dtype: object

In first PPO strategy, we tested with AAPL and in second we tested with BABA. In BABA, we lost money but in AAPL we made some.

There are many features and stock backtesting strategy to try on stock backtesting using Backtesting.py and those will be covered in next part. Thank you :)

Comments